Our New Portfolio Addition is ASX: TRI

Disclosure: S3 Consortium Pty Ltd (the Company) and Associated Entities own 18,820,000 TRI shares at the time of publishing this article. The Company has been engaged by TRI to share our commentary on the progress of our Investment in TRI over time. 14,000,000 shares are subject to shareholder approval.

Today we are announcing our third new Investment for the year.

This one is in the medtech / biotech / artificial intelligence (AI) space.

Three themes that we are very interested in.

One of our best ever Investments was an “undervalued and unloved MedTech” called Oneview Healthcare back in 2021.

Oneview went as high as 10x, and now trades comfortably around 5x where we first Invested.

Our biotech Investments have also been performing well:

- In 2021 we added Dimerix - highest point from our Initial Entry of 84%

- In 2022 we added Arovella Therapeutics - highest point from our Initial Entry of 387%

- In 2023 we added Neurotech International - highest point from our Initial Entry of 191%

(Remember that the past performance does not mean future portfolio additions will perform in a similar way. Investing in small cap stocks is risky)

On the AI side, this company has been developing its AI product for years BEFORE AI became the world’s hottest Investment thematic.

With many companies jumping on the AI bandwagon lately, true AI companies are rare on the ASX.

This company combines three of our current favourite Investment thematics - AI, biotech and medtech.

And it's currently capped at ~$11M - ahead of some major clinical trial catalysts over the coming months.

Introducing:

~$11M capped TRI has developed an AI powered algorithm to screen for mental health disorders by analysing a patient's sleep data.

Its Phase 2 clinical trial results are expected in the coming months...

Mental health is one of the most pressing problems in the world.

“According to the World Health Organisation, around 1 billion people globally (that’s about 1 in every 8 humans) are living with some sort of mental disorder, with anxiety and depression the most common.”

Currently, screening methods for mental health disorders (especially depression) are subjective and viewed by some psychiatrists as “quick and dirty”.

It’s often inaccurate because it's done by taking surveys of how patients “feel” via a simple series of 9 questions. (Source)

It’s all very subjective.

You’ve probably taken one of these surveys before, and struggled to ‘rate’ yourself:

An analogy that most people will know is like thinking you MIGHT have COVID because you have an itchy throat or “feel” foggy...

Versus taking an actual COVID test that gives you a more definitive yes/no result based on the presence of actual COVID in your body.

Can this kind of test be achieved for issues with the brain?

The holy grail of screening\diagnostics is to identify what’s called a “biomarker” - irrefutable physiological evidence produced by the body that can be used to confirm the presence of a disease/ailment.

(imagine testing for COVID via a survey questionnaire instead of an actual COVID test...)

But is objective, accurate, testing for mental health disorders possible?

(if YES - we think this will be a game changing new discovery)

TRI is currently running a Phase 2 trial on 400 patients hoping it can successfully screen for depression (specifically a current Major Depressive Episode- cMDE) based on their AI algorithm identifying biomarkers for depression in their sleep data.

(basically the AI algorithm is finding patterns in brain waves and heart rate that match up with those found in actually depressed patients)

These trials are being conducted at in-clinic sleep studies.

TRI’s Phase 2 clinical trial results are due in the coming months, which we think could be a major catalyst for TRI if successful.

Accurately screening for depression has a huge market in itself.

The blue sky for TRI here is that if it turns out that sleep data CAN successfully be analysed by its AI to screen for depression, it is likely able to screen for OTHER mental health issues too.

(like anxiety, PTSD, bipolar, alzheimer's, etc - all huge markets on their own)

And then down the track, TRI’s AI could be refined to potentially be integrated into wearables like a Fitbit, Apple Watch or Oura Ring that all track simplified sleep data.

Imagine getting your step count for the day, your sleep quality data AND an early warning to take some action on a potential mental health issue that may be creeping up.

That’s the “blue sky” upside for our Investment in TRI.

But the first step is to wait for the TRI Phase 2 clinical trial results on screening for depression, due in the next couple of months...

TRI has actually been developing this technology on the ASX for over a decade, and $10’s of millions have already been spent.

Despite all of that time, investment TRI is currently capped at ~$11M.

Given the company is currently running Phase 2 clinical trials we think the ~$11M market cap does not reflect the value of the underlying assets.

Missed timelines and “taking on too much too soon” from a strategy perspective (under TRI’s previous management and trading name, Medibio) created a base of shareholders that were stale and disengaged and started selling, causing the share price to suffer despite what we believe are valuable and high potential assets.

We like these kinds of entry points, at a time when we believe a company is on the cusp of finally delivering what previous, long suffering shareholders had been waiting years for (and also funding the work).

Many biotechs we have looked at and invested in at Phase 2 clinical trial stage are usually trading at a significantly higher market cap.

Over the last 12 months TRI’s board and management team has been completely transformed as well.

One of the new team has previously founded companies that have helped digitise the diagnostic process for psychiatric disorders.

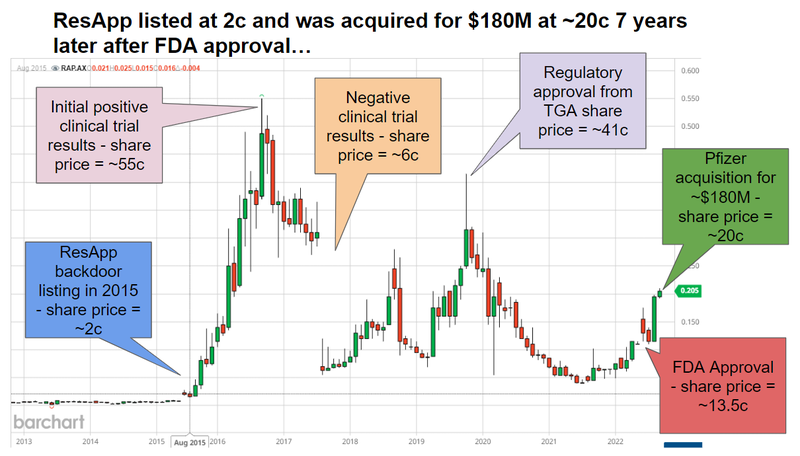

Another was an early director and financier of ResApp Health - the ASX listed diagnostic technology company that Pfizer took over for $179M in 2022.

(ResApp screened for respiratory diseases by analysing the sound of a patients coughing - in the same vein as how TRI screens for mental health issues by analysing patient sleep data)

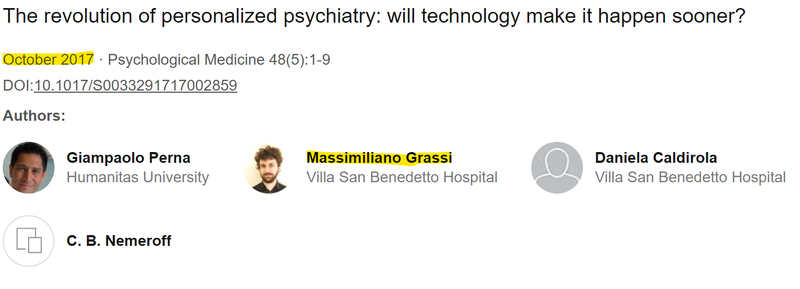

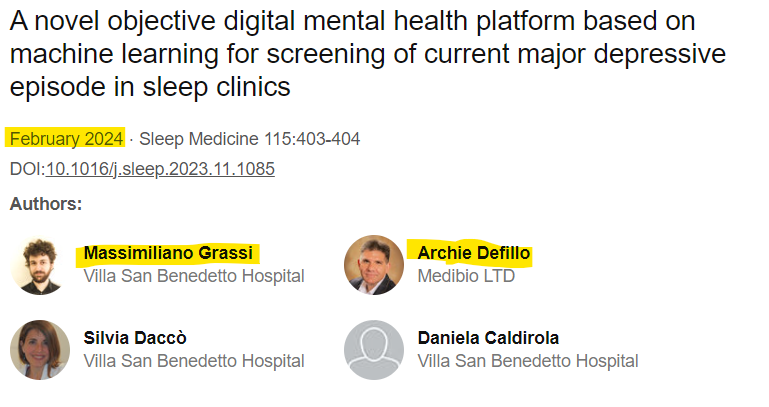

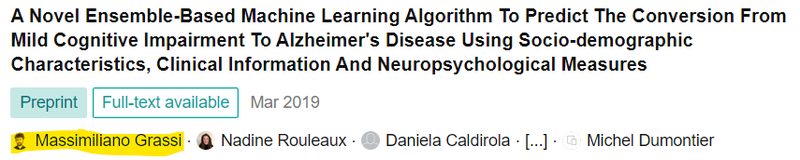

Neurosurgeon Dr Archie Defillo and AI specialist Dr Massimilano Grassi are the brains behind TRI’s technology and continue to progress it.

We are backing the current, refreshed TRI team to take the company’s technology stack, further refine it, validate it with clinical trials and hopefully repeat a ResApp style success.

With TRI’s $11M market cap entry point, we like the leverage to future success.

(Like all early stage investments though, success is not a guarantee, and the past performance of ResApp does not mean TRI will perform the same way)

TRI’s novel products are aimed at sleep research organisations in the US, targeting the US$15 billion sleep medicine market.

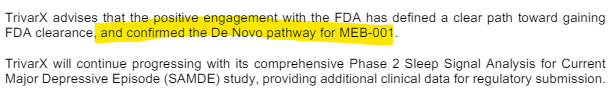

TRI has already met with U.S. Food and Drug Administration (FDA) which approves all new medical treatments and devices for sale in the US, and TRI has a pathway to FDA approval.

If successful, TRI could have the first FDA approved, objective, and evidence-based approach to the screening and monitoring of mental health disorders from sleep data.

TRI just raised $2.5M at 2.5c per share and has a tiny market cap of ~$11M.

We participated in the TRI placement.

We think the current valuation offers a good entry point given the refreshed board & management team.

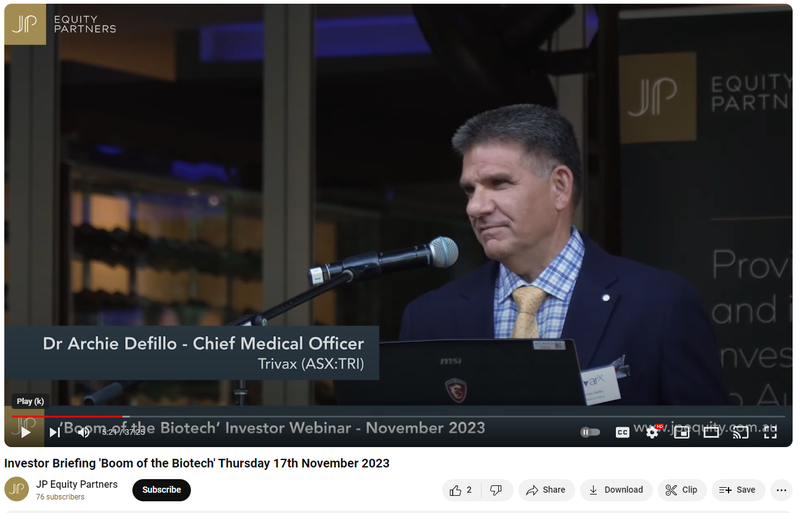

Neurosurgeon and TRI Chief Medical Officer Dr. Archie Defillo says in his presentations that he believes “Sleep is the window into mental health”.

If TRI’s upcoming trial results prove this to be true, then we think TRI’s AI to screen for mental health issues from sleep data could have huge implications...

Reasons why we Invested in TRI

- Screening for mental health issues from sleep data - novel solution to a serious problem. Current methods to screen for mental health are subjective and inaccurate, resulting in patients not receiving the right treatment. TRI is using AI to analyse sleep data to provide objective, accurate screening for mental health issues.

- Genuine AI (Artificial Intelligence) exposure - TRI didn’t just start working with AI once it became a popular investment thematic in recent months. TRI has a Head of AI, Dr Massimiliano Grassi, who has been doing AI for psychiatry for at least 6 years. TRI’s algorithm has advanced to Phase 2 trials and is getting better as time passes and more data is collected.

- ~$11M market cap - undervalued and unloved Medtech? - like our successful Investment in Oneview, our view is that TRI is undervalued at ~$11M considering the 9 years of investment into its tech & with a Phase 2 trial being run. We think this is a great entry after years of hard work with the right team to take TRI forward now in place.

- Imminent Phase 2 clinical trial results - 400 patients sleep data is being screened for depression using TRI. IF the trial result is positive, it could open the door to US FDA regulatory approvals and potentially even training the AI algorithm to screen for other types of mental health issues too. The final results are expected in the next couple of months. We think they will be a catalyst for TRI’s share price.

- Path to FDA approval - TRI has engaged with the FDA and the “De Novo” pathway was defined by the regulator, a type of FDA approval which is generally longer and more rigorous but reserved for genuinely new medical devices, which we think TRI’s algorithm is.

- USA based story and market - TRI has a US-based tech team and is going for the lucrative US healthcare market - which is the huge, clearly trodden pathway for big exits in biotech/medtech.

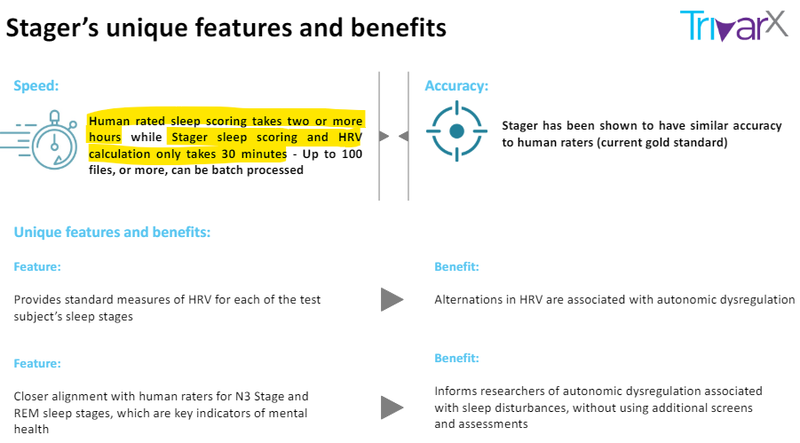

- Near term revenue opportunities (Stager) - US$15BN market - Commercial roll-out of TRI’s sleep staging software for sleep clinics - commercialisation is underway with licensing agreements and partnerships anticipated 2024. TRI’s novel products are aimed at sleep research organisations in the US, targeting the US$15 billion sleep medicine market.

- Proven new management team with key backers - recently appointed board and management team with significant success in US and global healthcare markets, including founding directors/financiers of Race Oncology ($600m+ market cap 2021) and ResApp Health, which Pfizer ended up taking over for ~$180M in 2022.

- Long term technical team retained (AI experts and human brain experts) - Neurosurgeon Dr Defillo and AI specialist Dr Grassi are the brains behind TRI’s tech - they’ve been involved together since 2019 and both bring a special skill set that we think will drive TRI’s success.

- Major shareholder is Fidelity Investments - one of the largest fund managers in the U.S, is the #1 shareholder in TRI with a ~10% holding in the company.

- Potential to screen for other psychiatric disorders - if it turns out that sleep data CAN successfully be analysed by its AI to screen for depression, it is possible that the AI can be trained to screen for OTHER mental health issues too.

- Potential to integrate TRI’s tech into wearables - TRI’s tech may potentially be integrated into wearables like a Fitbit, Apple Watch or Oura Ring that all track simplified sleep data. That’s a big commercial opportunity in our eyes.

Revamped TRI is aiming to make a big advancement in mental health screening

Ever woken up on the “wrong side of the bed”?

Clearly, humans have known for a long time that sleep affects mood.

Turns out, there is a strong scientific basis for this being the case too.

TRI’s Chief Medical Officer, Dr. Archie Defillo and Head of AI Dr Massimilano Grassi have been working together on TRI’s depression screening technology since 2019.

Grassi first advanced the prospect of technology driven solutions to mental health in a 2017 paper:

(Source)

One of the co-authors of that paper was Dr. Giampaolo Perna - with 195 papers published, Perna is perhaps one of the foremost academic authors on the intersection of psychiatry and technology in the world. (Source)

So TRI’s head of AI, Dr. Grassi has some serious pedigree based on this connection alone.

Then in 2019 Dr. Defillo and Grassi teamed up to work for TRI when it was called Medibio - a lot has changed since then on the corporate front (more on this later).

Dr. Defillo is a neurosurgeon who works out of the US in Minnesota.

Dr. Defillo provides the insights from decades of experience with the brain - Dr Grassi (who has a PhD in Psychiatry) builds out the AI tech to make sure everything matches up.

Six years of work together has produced lots of academic publications and just three months ago, Drs. Grassi and Defillo delivered another paper:

(Source)

This is where things start to get really interesting for us as Investors.

TRI has honed in on a way to identify current Major Depressive Episodes (cMDE).

The screening technology relies on an algorithm which sorts through large volumes of data collected in a sleep clinic - TRI calls this “Supervised Artificial Intelligence”.

When a patient attends a sleep clinic - a polysomnography (sleep study) is performed.

An array of sensing devices are attached to the patient that measure things like brain waves, heart rate, eye movements, air flow etc.

TRI’s algorithm is particularly focussed on the connection between the readings from the electroencephalogram (brain waves - EEG) and the electrocardiogram (heart rate - ECG) which enables the technology to map the connectivity between brain and heart activity throughout sleep stages.

The algorithm identifies patterns in this mass of data that are also present in those experiencing a current Major Depressive Episode (cMDE) as diagnosed by a doctor.

With AI - TRI is then able to pick out sleep clinic patients with this type of depression with impressive and improving accuracy.

This AI was developed before AI became the world’s hottest investment theme and before the ChatGPT-led craze came about last year.

(This is a big plus for us as Investors, with many companies now trying to rebrand themselves as “AI driven” to jump on the bandwagon)

As a result, TRI has a big head start on potential new entrants to the market - and a growing body of clinical trial evidence to support its potential regulatory approval and commercialisation.

IF successful, TRI would become the first FDA approved medical device to screen and monitor for current Major Depressive Episode (cMDE) using data from sleep studies.

Dr. Defillo said in a November presentation that “Sleep is the window to mental health” - and it resonated with us.

Check out that presentation here.

(Source)

Key points from Dr. Defillo:

- When CT scans and MRIs came into the market - we could see the brain on the inside. BUT “Psychiatry was left behind.”

- “When you are depressed it's not just your brain - its your body”

- When you are depressed, your brain is telling your heart something - and heart rate goes up.

- By studying patterns in biomarkers during sleep AI - AI is a “gift” that allows us to “see” things that the human eye cannot see.

What Dr Defillo and Dr Grassi have done is bring AI to bear on huge volumes of data collected on people that are sleeping - and then, reliably CONNECT that data with an actual mental health disorder - initially depression.

(and with the potential for the AI to be trained to screen for many other mental health issues)

We think this could be a major improvement on current screening methods.

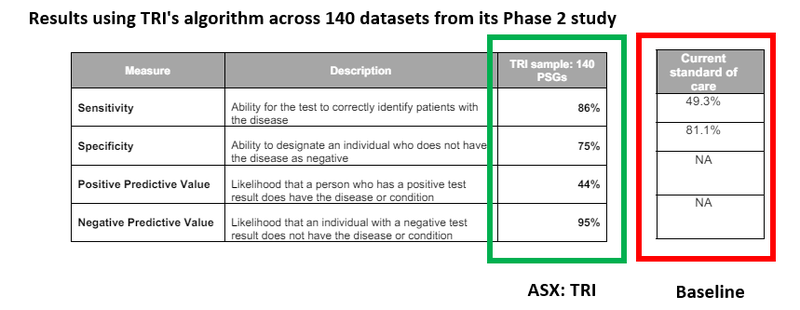

AND TRI’s algorithm recently posted some pretty strong results relative to the current standard of care:

(Source)

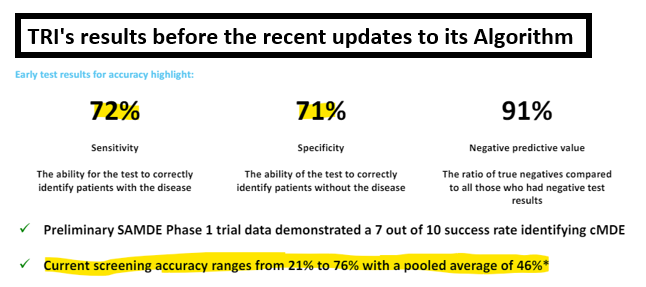

This was a solid improvement on the Phase 1 trial results, clearly the algorithm is learning:

(Source)

Bearing in mind that current depression screening tools at the moment have an accuracy rate of less than 50%. (Source)

That means the chance that a patient goes on to be correctly diagnosed with depression is effectively a coin flip.

The results above were from data gathered on 140 patients - we hope the results get stronger as TRI refines its algorithm against larger and larger datasets.

(We’re hoping it can eventually be expanded to other mental health issues as well)

Better screening, means better treatment, and ultimately this means healthier patients.

The current standard screening method is what’s called the PHQ-9 questionnaire.

PHQ-9 has been around since the 90’s and to date it remains the go-to screening method for depression.

Often administered by nurses, the estimated accuracy of the questionnaire is not ideal - there are lots of false positives. (Source)

That is, people who don’t have the condition (depression) still wind up being referred to a doctor who performs the actual diagnosis through a semistructured interview called a MINI. (Source)

Humans aren’t perfect of course, and some people slip through the cracks or wind up in a place they shouldn’t be.

We think the +25 year old PHQ-9 could be replaced with a more objective test that uses AI on sleep data - and TRI could be the company to deliver that much needed improvement.

Ultimately, medical screening is a sorting task.

As technology advances we think that task will increasingly be placed in the hands of more accurate tech based tools, like TRI’s algorithm.

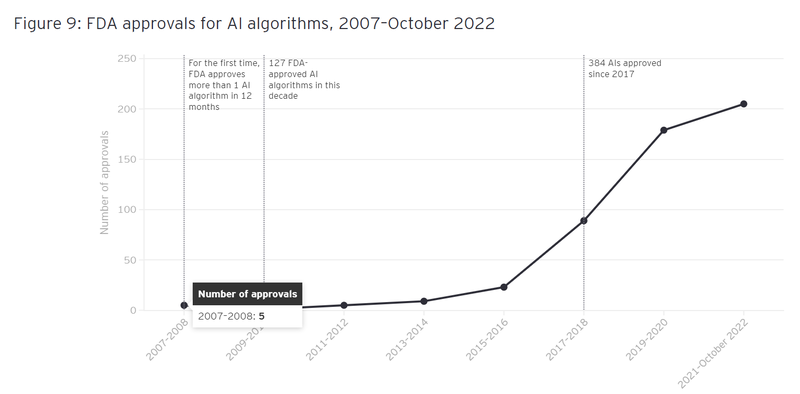

We can see that the FDA has a growing appetite for algorithm based medical tech innovations - something which is evidenced in recent increase in FDA approvals for AI based algorithms:

(Source)

That trend should only get stronger - and we’re hoping TRI’s algorithm can be one of the next cabs off the rank if the clinical trial data is up to scratch.

But we know that mental health is a particularly sensitive issue for both patients and regulators alike - which may partly explain the FDA’s reluctance to give TRI (then Medibio) regulatory approval in the past.

Things are changing rapidly though - tech is getting better, TRI’s algorithm included.

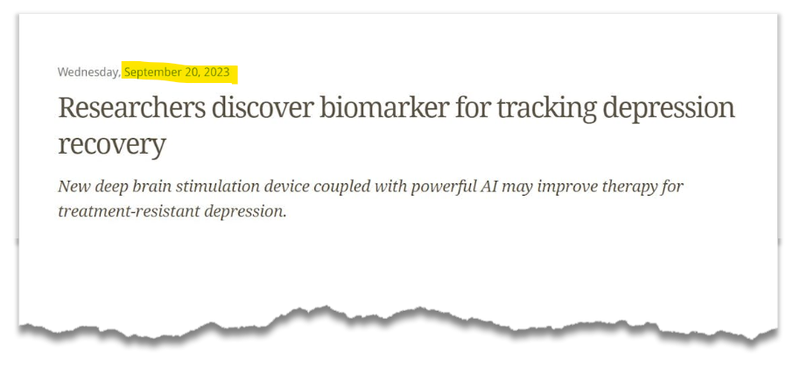

AI applications to biomarkers as it relates to depression got significant traction in September of last year:

(Source)

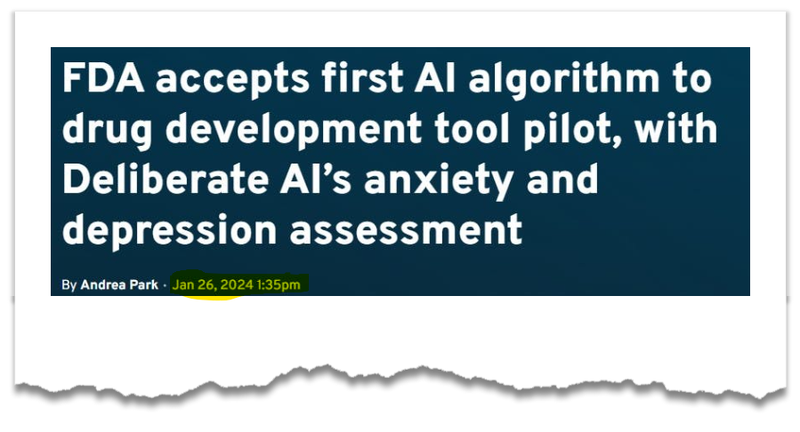

And just this year, THIS happened:

(Source)

There’s a great precedent for this type of medtech advancement on the ASX as well.

This is the model for what TRI could become if the right pieces click into place...

What does success look like for TRI?

We think TRI can follow a similar trajectory to one of the great ASX medtech success stories - ResApp.

ResApp developed a diagnostic tool that could detect and identify various respiratory conditions based on the sound of a cough made into a smartphone microphone using an algorithm.

ResApp began life as a University of Queensland based start up - and did a backdoor listing in 2015 when the share price was sitting at a market cap of ~$11M and had a share price of ~2c.

7 years later in 2022 the now US$224BN capped Pfizer acquired ResApp for ~$180M at a share price of 20.8c:

The past performance is not and should not be taken as an indication of future performance. Caution should be exercised in assessing past performance. This product, like all other financial products, is subject to market forces and unpredictable events that may adversely affect future performance.

ResApp went through a couple waves of strong sentiment, before it was ultimately acquired at a nearly 1,000% share price premium to the entry price for investors that backed the company when it backdoor listed.

We are Investing in TRI to hopefully see it achieve similar success by first validating its technology in clinical trials, getting regulatory approvals and then eventually commercialising the tech.

Eventually if TRI can kick enough goals it could make itself a takeover target for a larger pharma company.

Part of the reason Pfizer’s attention was drawn to ResApp was a string of commercial deals that the company was able to sign.

Here’s how TRI intends to pursue its commercial strategy...

Commercialisation: How will TRI make money?

TRI’s commercialisation strategy is currently based on two products:

- Stager (a sleep staging software package for sleep clinics)

- MEB-001 (the algorithm that identifies current Major Depressive Episode in sleep clinic patients)

Stager has already been used in at least 3 US sleep clinics - which we think provides a great introduction to potential customers who may want to use MEB-001 for screening if it gets regulatory approval.

Stager helps sleep clinics accurately stage sleep cycles, (wake, N1, N2, N3, and REM) but at a rapid pace, around one third of the time it takes humans:

(Source)

At the moment, a worker in the sleep clinic has to sit there and visually identify across sensor data over an 8 hour period what stage of sleep the patient is in.

It’s time consuming, laborious, ungratifying work that costs money and is prone to human error - perfect for a TRI disruption.

There’s big money in sleep clinics as well - people are increasingly desperate to get a good night’s rest.

Currently the total annual spend from US sleep clinics sits at US$520M - and with ~4700 sleep clinics in the US, the sleep clinic industry is projected to be worth ~$16BN by 2028.

That’s a great starting point for TRI - but our hope is that with the blessing of regulatory approval from the FDA, large medtech companies (and maybe even Big Tech giants) wake up to what TRI has achieved.

Can TRI’s tech team replicate their AI success on other mental health disorders?

That’s the first big blue sky opportunity.

What about building a similar algorithm for chronic anxiety?

PTSD?

Bipolar disorder?

What about Alzheimer's?

TRI Head of AI Dr. Grassi has already worked on Alzheimer’s...

(Source)

It’s not too outlandish to see what could be afoot here.

Get regulatory approval and commercial traction on a smallish, less ambitious target with depression, then expand to other disorders.

Next step?

A potential blue sky opportunity in wearables like FitBits and smartwatches.

We certainly watch our phone’s sleep data closely already:

(Source)

And we’re not saying a smartwatch will diagnose a wearer with depression (...yet, imagine that) - but it could certainly do some screening tasks and ping you with an alert that you might be due for a chat with an actual doctor.

This could be the next frontier of medical technology and it could help a lot of people get the treatment they need.

A lot of work has gone into getting TRI to this point, and we’re Invested now because we see this as a good time for it to “emerge” and complete its turnaround.

Our “Emerge” Portfolio: TRI ticks all the boxes

This is what we look for in an Emerge Portfolio Company:

- Real, later stage company with a genuinely valuable asset/business

- Company had fallen on hard times, bad luck that was not within its control

- OR previously ineffective board/ management team has been replaced

- Currently or recently recapitalised, fresh cap structure and clean balance sheet to execute business plan

- Sentiment swinging towards the macro theme in which the company operates

- Another chance to execute business with fresh, new investor base

TRI fits the bill perfectly for this style of Investment for us.

With a new board, an improved product and a Phase 2 clinical trial underway, we're hoping for TRI to “emerge” and replicate ResApp’s success.

ResApp was conducting a similar sized study on its respiratory algorithm way back in 2015/2016 and re-rated from 2 cents to 55c in the space of around a year.

That took ResApp to a market cap of ~$240M in September 2016 after releasing positive results from its clinical study on 322 patients. (Source)

ResApp submitted a “De Novo” application to the US FDA like TRI intends to do:

(Source)

ResApp was knocked back from its De Novo application and with further effort secured what’s called 510(k) FDA clearance.

Shortly after that clearance was secured - Pfizer moved in to acquire ResApp for $180M.

Ideally, TRI gets approval on the De Novo application at first crack.

But it may take some time to win over the regulators, and we will hold the majority of our TRI position for a minimum of two to three years if TRI needs to provide additional clinical validation to the US health regulator (see Investment Memo below for more detail).

In short - TRI is a real, later stage company with a genuinely valuable asset/business.

As for the past board - the share price action during this period was not stellar. We think the new board which was put in place in between 2022-2023 offers a much better set of skills and experience for success.

- David Trimboli - a prominent Australian investor, director at multiple ASX companies

- Dr Tom Young - prominent US based mental health and medical technology expert

- Chris Ntoumenopoulos - runs a health technology focussed fund, previous director at Race Oncology and ResApp.

Finally, with a refreshed register and new Investors such as ourselves, TRI has a new chance to execute its business strategy.

What’s next for TRI?

So that we can follow the company’s progress over time and track our Investment, today we will be launching our TRI Investment Memo, where we share:

- What TRI does

- The macro theme

- Our TRI Big Bet

- What we want to see TRI achieve

- Why we are Invested in TRI

- The key risks to our Investment Thesis

- Our Investment Plan

TRI Investment Memo

What does this company do?

Trivarx (ASX:TRI) is an AI-driven mental health technology company seeking to commercialise objective measures to aid in the early detection and screening of mental health conditions, such as depression.

What is the macro theme?

We expect technology to play an increasingly important role in mental health care - FDA approvals for medtech algorithms have ramped up dramatically in the last few years. But there are few algorithms for the mental health space. Billions of dollars are being invested in mental health technology companies and startups, and AI is one of the hottest investment thematics right now.

Our Big Bet for TRI

“TRI re-rates to a $250M plus market cap on successful clinical trial results for screening one or more mental health disorders and/or is acquired for multiples of our Initial Entry Price”

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our TRI Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

12 Key reasons why we Invested in TRI:

- Screening for mental health issues from sleep data - novel solution to a serious problem. Current methods to screen for mental health are subjective and inaccurate, resulting in patients not receiving the right treatment. TRI is using AI to analyse sleep data to provide objective, accurate screening for mental health issues.

- Genuine AI (Artificial Intelligence) exposure - TRI didn’t just start working with AI once it became a popular investment thematic in recent months. TRI has a Head of AI, Dr Massimiliano Grassi, who has been doing AI for psychiatry for at least 6 years. TRI’s algorithm has advanced to Phase 2 trials and is getting better as time passes and more data is collected.

- ~$11M market cap - undervalued and unloved Medtech? - like our successful Investment in Oneview, our view is that TRI is undervalued at ~$11M considering the 9 years of investment into its tech & with a Phase 2 trial being run. We think this is a great entry after years of hard work with the right team to take TRI forward now in place.

- Imminent Phase 2 clinical trial results - 400 patients sleep data is being screened for depression using TRI. IF the trial result is positive, it could open the door to US FDA regulatory approvals and potentially even training the AI algorithm to screen for other types of mental health issues too. The final results are expected in the next couple of months. We think they will be a catalyst for TRI’s share price.

- Path to FDA approval - TRI has engaged with the FDA and the De Novo pathway was defined by the regulator, a type of FDA approval which is generally longer and more rigorous but reserved for genuinely new medical devices, which we think TRI’s algorithm is.

- USA based story and market - TRI has a US-based tech team and is going for the lucrative US healthcare market - which is the huge, clearly trodden pathway for big exits in biotech/medtech.

- Near term revenue opportunities (Stager) - US$15BN market - Commercial roll-out of TRI’s sleep staging software for sleep clinics - commercialisation is underway with licensing agreements and partnerships anticipated 2024. TRI’s novel products are aimed at sleep research organisations in the US, targeting the US$15 billion sleep medicine market.

- Proven new management team with key backers - recently appointed board and management team with significant success in US and global healthcare markets, including founding directors/financiers of Race Oncology ($600m+ market cap 2021) and ResApp Health, which Pfizer ended up taking over for ~$180M in 2022.

- Long term technical team retained (AI experts and human brain experts) - Neurosurgeon Dr Defillo and AI specialist Dr Grassi are the brains behind TRI’s tech - they’ve been involved together since 2019 and both bring a special skill set that we think will drive TRI’s success.

- Major shareholder is Fidelity Investments - one of the largest fund managers in the U.S, is the #1 shareholder in TRI with a ~10% holding in the company.

- Potential to screen for other psychiatric disorders - if it turns out that sleep data CAN successfully be analysed by its AI to screen for depression, it is possible that the AI can be trained to screen for OTHER mental health issues too.

- Potential to integrate TRI’s tech into wearables - TRI’s tech may potentially be integrated into wearables like a Fitbit, Apple Watch or Oura Ring that all track simplified sleep data. That’s a big commercial opportunity in our eyes.

What do we expect TRI to deliver?

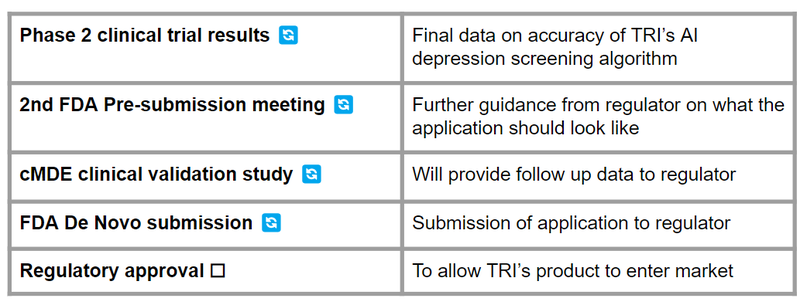

Objective #1: Complete Phase 2 clinical trial, release results

TRI is currently conducting a Phase 2 trial in the US on its algorithm for detecting current Major Depressive Episode (cMDE). Final results are expected in the June quarter (before July 1st 2024).

Milestones

🔲 Phase 2 clinical trial results

🔲 Potential additional clinical validation studies

Objective #2: Regulatory approval - FDA De Novo application

TRI will be engaging with the US health regulator (FDA) to bring its product to market. This involves an De Novo application - which would classify its product as “low-risk” and therefore help speed up the approvals process and get TRI’s product to market quicker.

Milestones

🔲 2nd FDA Pre-Submission Meeting

🔲 FDA De Novo Application submission

🔲 Outcome of FDA De Novo Application

Objective #3: Appoint MD/CEO & outline commercialisation strategy

We want TRI to appoint a Managing Director or CEO with the right skills and experience to take TRI’s product into the market. After that we want to see the company sign commercialisation deals. TRI is currently undertaking an executive search for the role.

Milestones

🔲CEO search starts

🔲CEO appointed

🔲Licensing deal #1 - Stager software

🔲Licensing deal #2 - AI depression screening algorithm

What could go wrong?

Regulatory risk

It is possible that health regulators do not approve a new screening product like TRI’s. The regulator could require additional data, or reject the application outright. TRI has previously failed with a “Breakthrough” FDA designation and despite taking a more streamlined approach to regulatory approval - this approval is not guaranteed. An adverse outcome from the regulator could hurt the TRI share price.

Competition risk

AI is accelerating at a significant rate - new market entrants could make TRI’s product for depression screening redundant.

Clinical trial risk

Clinical trial outcomes are never certain - TRI might not be able to generate results good enough for the regulator to approve the product. Clinical trials, even low cost ones, require capital in order to be conducted. A clinical validation study, which TRI may also have to complete could cost additional money.

Funding/dilution risk

Small caps often need to raise cash to fund their growth. TRI is not generating any revenue and may need to raise capital, potentially at a discount. Capital raises may dilute existing holders.

Market risk

Broader market sentiment can get worse and speculative stocks as a whole trade lower, taking TRI’s share price with it. Alternatively, there could be further sector specific pain ahead. For example, the biotech sector sells down.

What is our Investment Plan?

Our Investment Plan for TRI is to hold on to a majority of our position to see the company execute on its business strategy over the next two to three years.

If the company’s share price materially re-rates in the medium term due to the results of the Phase 2 clinical trial results, a commercialisation deal, a macro triggering event or any other unknown reason, we may look to sell up to ~20% of our holding. See our general hold policy for more details.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.